how much tax do you pay for uber eats

Thank you for confirmingLink has expiredYour message has been sent and an agent will be with you soon. Your federal income tax return includes this amount.

How Does Uber Eats Work About Uber Eats

Uzochukwu From your question I am assuming you are a new driver to Uber.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972748/Screen_Shot_2019_03_19_at_1.52.15_PM.png)

. Those who earn 400 or more from their ridesharing business may have to pay self-employment taxes. Your 1099 should be there by January 31st. The main exception is that you dont have to pay income taxes if your total annual income is less than the standard deduction which is 12550 if youre a single-filer for 2021 taxes what you file in early 2022 and.

Im an Uber Driver. You should file a Form 1040 and attach Schedule C and Schedule SE to report your Uber income. In this case you should aim to save at least 30 of your income.

There will be a 15-dollar fee. If you have any other questions or issues please visit the Uber Help CenterYour link has expired as it has exceeded the 24-hour time window. Your average number of rides per hour.

On average however Uber Eats drivers hourly pay is around 20-25hour. As a gig economy contractor your self-employment taxes are almost always higher than income taxes. Regardless of how much you make according to the ATO any income you earn as a food delivery driver must be declared on your tax return.

If you have questions on whether you need to register for GST due to how you partner with Uber we would recommend you contact the ATO or a taxation professional directly for advice. Suppose the pickup fee is 150 the mileage fee is 050mile the time fee is 020minute the drop-off fee is. Yes now you do they used to have them self employed where you did your own tax and of course half of them were not doing it or not doing it properly but nowadays they have you working for one of the temp agencies like Randstad or.

You will receive one tax summary for all activity with Uber Eats and Uber. Your federal tax rate can vary from 10 to 37 while your state rate can be anywhere from 0 to 1075. The average number of hours you drive per week.

These are the rates you can expect to earn after deducting expenses including Ubers cut. If you had 20000 in earnings and 10000 in expenses your profit is 10000. How Much Tax Do You Pay As An Uber Eats Driver.

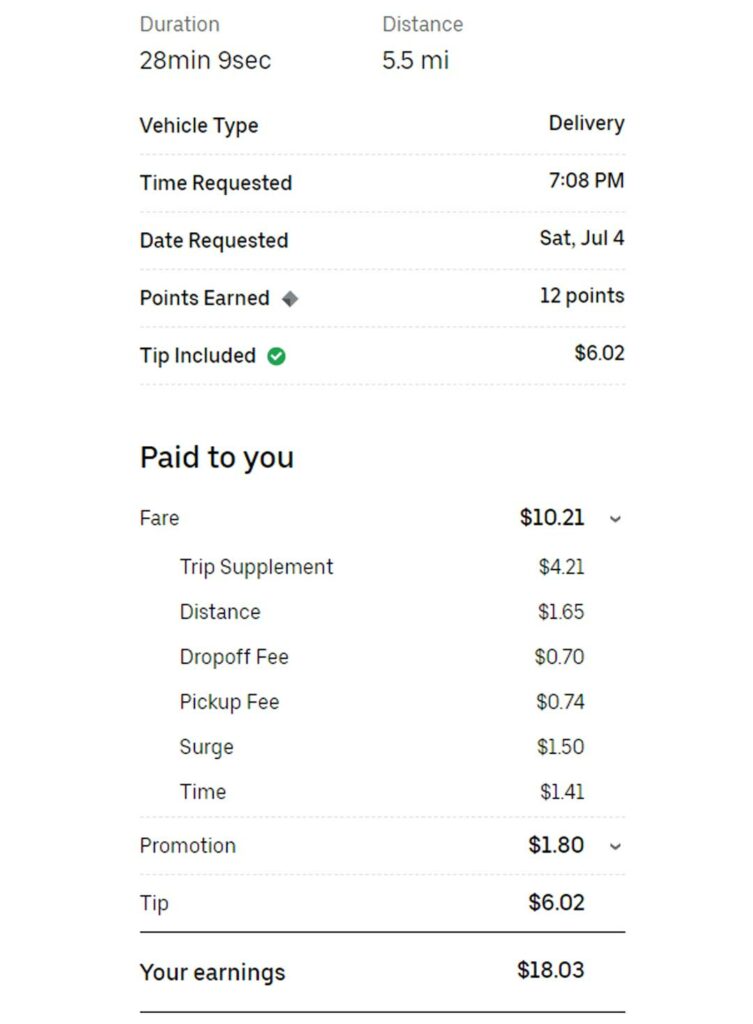

The money left over is the basis for your taxes. It is important that you keep all of your mileage. Payout pickup fee mileage fee time fee drop-off fee Ubers fee tips.

If your net earnings from Uber exceed 400 you must report that income. For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income tax rate goes higher than the 153 self-employment tax. Answer 1 of 6.

The 10000 is the taxable income not the whole 20000. For example I turn on my app when I. How does UberEats work with taxes.

The current surcharge is scheduled to remain in place for the next 60 days. Please note however that if you are a delivery partner who uses the UberEATS app and you do not provide ridesharing services you should only need to register. This includes revenue you make on Uber rides Uber Eats and any other sources of business income.

Dont rely on Ubers figures for mileage. Lets make it clear with an example. Then you subtract the expenses from the income.

The city and state where you drive for work. Tax on 92 percent for SECA was 3 percent. 9 per hour if youre paying for your car through car finance.

Delivery driver tax obligations. The exact percentage youll pay depends on your state and your tax bracket which is usually based on how much you earned over the calendar year. Approximately 5652 came from 35 percent of this amount.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. There are two places you can find your Uber 1099 forms. If youre not required to file an income tax return and your net earnings from Uber are less than 400 you arent required to report your Uber income.

Recently Ubers UK head of public policy Andrew Byrne revealed three typical hourly rates. Using our Uber driver tax calculator is easy. If you want to get extra fancy you can use advanced filters which will allow you to input.

As you can see how much you can make with Uber Eats depends on a variety of factors with one of the most important being when and where you drive. The second type of taxes youre responsible for is self-employment taxes. How Much Do Full Time Uber Drivers Pay In Taxes.

Sign up to deliver with Uber Eats here. 950 per hour if you drive your own car. All you need is the following information.

8 per hour if you drive a hired car. I would keep all of your expenses and mileage in a spreadsheet. If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will separately determine if you meet the earnings and trip criteria to receive a 1099-K 1099-NEC andor a 1099-MISC.

This is why you MUST track your miles driven and your expenses. You can also find a copy of your 1099 in your Uber app by going to Account - Tax Info. During the 2021 tax year self-employment taxes will be levied at 15 percent.

A little less than 3 of the first 92. Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies. Its common for delivery drivers to have another job or receive an income from other ridesharing activities.

Your average earnings per ride. Look for the Tax Information tab. Please submit your issue again through the Uber Help CenterGo to homepage.

Heres the thing.

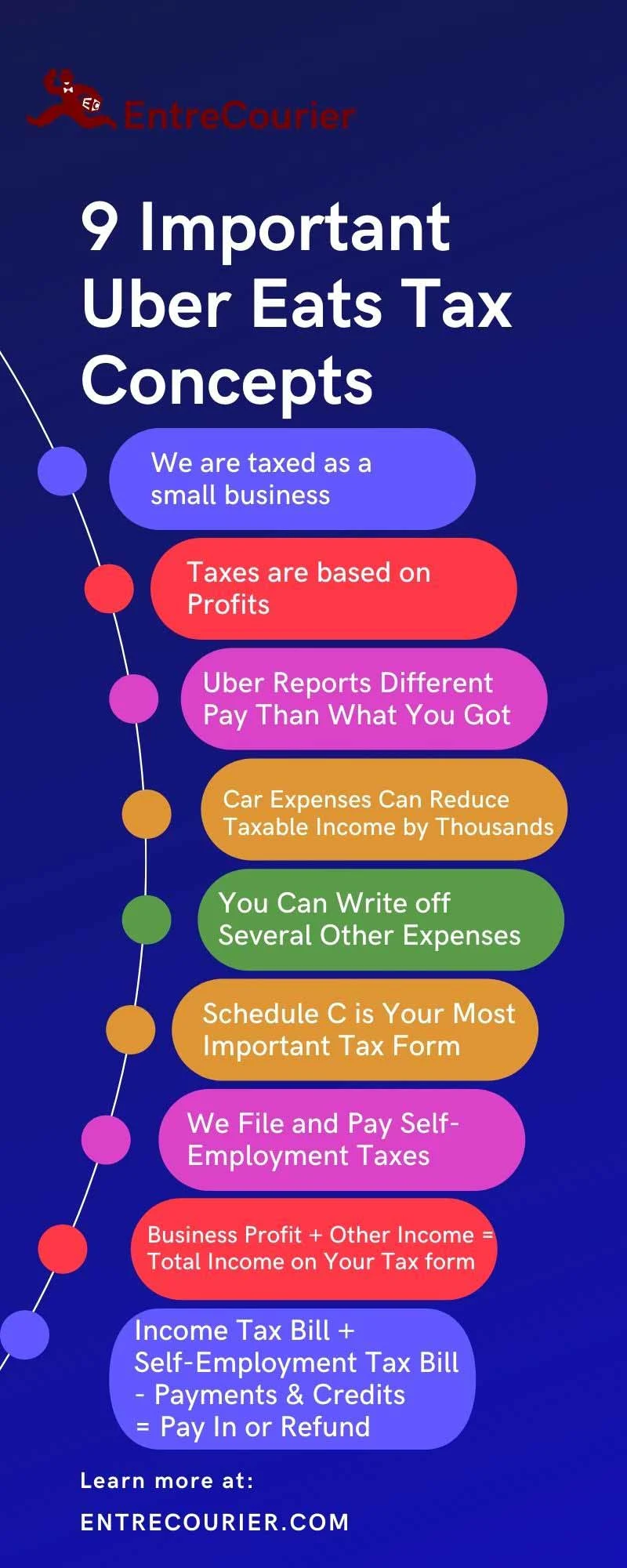

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

Is Uber Eats Delivery Jobs In Canada On Sin Or Not

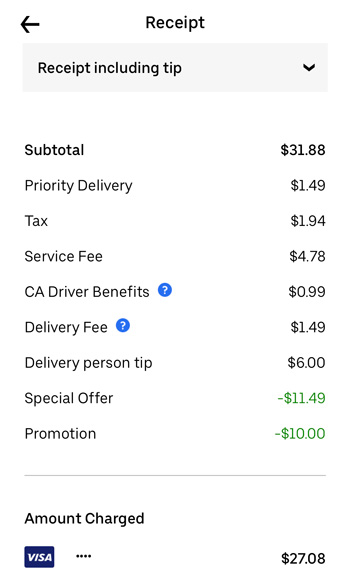

18 Dollar Difference Between Restaurant Receipt And The Uber Eats Receipt R Mildlyinfuriating

Is Uber Eats Worth It For Drivers Pay Requirements What To Expect

Do Uber Eats Drivers See Your Tip When You Order Food Online

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972766/IMG_4316.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

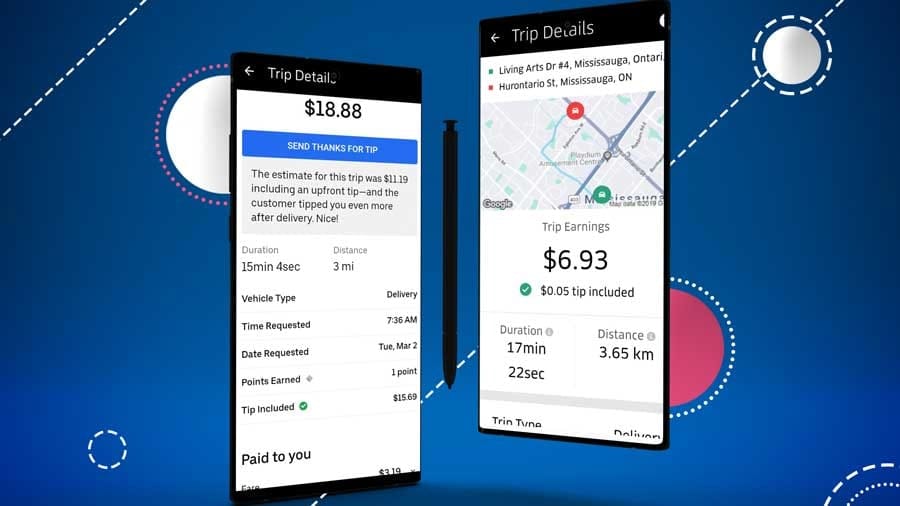

How Much Do Uber Eats Drivers Make How Pay For Drivers Works 2022

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972748/Screen_Shot_2019_03_19_at_1.52.15_PM.png)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Skipthedishes Vs Ubereats Vs Doordash Loans Canada

How Much Do Uber Eats Drivers Make How Pay For Drivers Works 2022

Proof That You Can Make 900 1400 Wk With Uber Eats Alone I M Only 20 So I Can T Drive People Around I Don T Want To Either R Uberdrivers

16 Must Know Uber Eats Tips Tricks 2022 Make More Money Driving

Uber Eats Driver App Complete Guide 2022 How To Use It

Highest And Lowest Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

The Uber Eats Business Model 2022 Update Fourweekmba

How To Prepare For Your First Delivery With Uber Eats For First Time Drivers Fangwallet